Congress extends flood insurance through November, avoiding NFIP lapse in midst of hurricane season

The National Flood Insurance Program, which writes policies for around a half-million Louisiana residents, will keep operating without a lapse through the end of hurricane season after the U.S. Senate voted to extend its authorization Tuesday.

The four-month extension — co-authored by House Majority Whip Steve Scalise, R-Jefferson — ensures policyholders will be able to renew their coverage and real estate agents won’t face an interruption while closing home sales.

It’s the seventh short-term extension for the NFIP, a federally run program that underwrites most flood insurance coverage in the country, since its authorization initially came up for renewal at the end of September.

Louisiana Sens. Bill Cassidy and John Kennedy, both Republicans, sponsored short-term flood deals of their own in the Senate and pressed leadership to force a vote on Scalise’s bill extending the NFIP through November. The House overwhelmingly backed the four-month extension last week.

Louisiana has roughly 500,000 NFIP policyholders and has repeatedly leaned on the program after devastating floods and hurricanes ripped through communities. Only fellow Gulf states Florida and Texas — with much larger populations — have more.

The series of short-term deals have come as lawmakers on Capitol Hill remain deeply divided over the future of the popular but financially beleaguered program. Payouts to policyholders following a series of destructive storms dating to 2005’s Hurricane Katrina have left the program roughly $20 billion in the red, even after Congress forgave $16 billion in NFIP debt last year.

Tuesday’s 86-12 vote averts a potential political showdown over the NFIP in the Senate. Three Republican fiscal hawks, including Utah Sen. Mike Lee, had threatened to filibuster the extension in a bid to force concessions from flood-state lawmakers.

Cassidy and Kennedy easily had the votes to break a filibuster — but the procedural delay could have forced a one- or two-day lapse in the program.

A group of conservative Republicans, led by House Financial Services Chairman Jeb Hensarling, of Texas, have pushed to eliminate subsidized and below-risk premiums for NFIP policyholders. Hensarling has argued the program encourages rebuilding in high-risk areas and has urged his colleagues to cut off coverage to homeowners whose properties repeatedly go under.

Louisiana’s congressional delegation and other lawmakers from flood-prone areas of the country have fought back against those proposals, which would increase premiums and hurt home values in at-risk areas.

Instead, they’ve pushed for investment in flood-protection projects and initiatives to expand the number of premium-paying policyholders to spread out risk.

“I appreciate Senate leaders listening to my request to move the vote up to today so that no one in Louisiana or the rest of the country is left in the lurch,” Cassidy said after Tuesday’s vote. “We now have four months to finalize a long-term plan that reforms the program to make it more affordable, accountable and sustainable.”

“It would have been bone-deep, down-to-the-marrow stupid to let the National Flood Insurance Program expire in the middle of hurricane season and my colleagues realized that,” Kennedy said.

Kennedy, though, said he’s concerned that his colleagues would make little — if any — progress on negotiating a long-term flood insurance overhaul between now and the new Nov. 30 deadline.

“There doesn’t seem to me to be middle ground with some members,” Kennedy said.

Groups representing policyholders, insurers, bankers and environmental groups praised the lapse-avoiding extension but urged lawmakers to work on a complete overhaul of the program. Just what those reforms might look like, though, remains a point of intense debate.

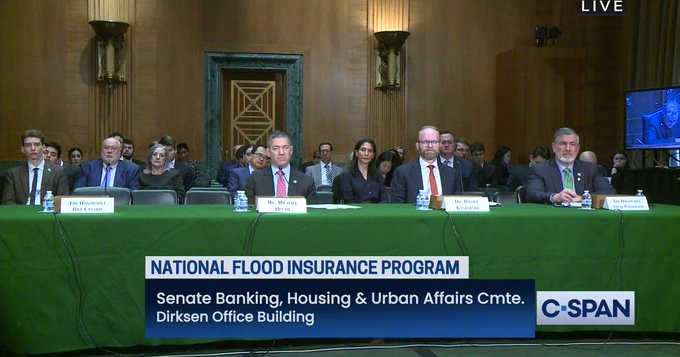

“We appreciate the extension in authorization as we continue to work on reforms to the NFIP that enhance mitigation options, improve the mapping process, ensure affordability and increase program participation,” said Michael Hecht, CEO of Greater New Orleans Inc., an economic development group that also leads a national flood insurance lobbying coalition.

“Congress should use the next four months to finally reform the program that has cost taxpayers almost $40 billion dollars,” the SmarterSafer Coalition, a group representing environmental, insurance and housing groups, said in a statement. “Leaders in Congress should not continue to allow short-term extensions that reinforce the status quo.”

The conservative Club for Growth, meanwhile, had unsuccessfully urged Congress to kill the NFIP entirely, calling it “a flawed program that creates nothing but perverse incentives and billions in federal debt.”

Several Louisiana lawmakers, including Kennedy, Cassidy and U.S. Rep. Garret Graves, R-Baton Rouge, had pushed for a six-month extension of the program that would shift negotiations about a long-term overhaul into 2019. Hensarling is retiring, and next year would no longer hold his influential House chairmanship.

But the NFIP’s critics dug in their heels, and, Kennedy said, a four-month deal became the only option to avoid a lapse. Another short-term punt in November night be even harder to win, Kennedy said.

“I want the Jeb Hensarlings to be term-limited out,” Graves told The Advocate at an editorial board meeting Tuesday morning. Graves called the four-month extension a win for Louisiana residents but said he would’ve preferred a longer extension for the program.

Graves said Hensarling and other critics of the program haven’t fully grasped its importance to families — whose most valuable asset is usually their home — and have looked at flood insurance through a far-too-narrow mathematical lens.

Graves said he’s optimistic that a long-term deal on flood insurance will incorporate money for better flood protection, programs to offer buyouts to homeowners with repeatedly flooded properties and other initiatives to keep premiums affordable.

Instead, lawmakers will face a new deadline to either extend or overhaul the NFIP in late November during the so-called “lame duck” session after the midterm elections but before new members take their seats.

To read the full article click.